Inpixon Stock Overview

Imagine buildings that whisper secrets about what happens inside them. Inpixon is like a detective, listening to those whispers and turning them into useful information. By tracking people, things, and even furniture, they build digital maps and learn how spaces work. We will discuss Inpixon, and at the end, you will know how the INPX stock predictions 2025 have been assessed.

This knowledge is a goldmine! Hospitals use it to find equipment faster, factories run smoother, and even stores know where their coolest toys are hiding. Inpixon wants to make buildings smarter, safer, and just plain awesome for everyone.

They use different tools like Wi-Fi whispers, Bluetooth clues, and even super-precise laser beams to see inside walls. In December last year, they even started a whole new company to share their detective skills with the world!

See? No jargon, no tech overload, just a story about buildings talking and making our lives better. That’s what Inpixon is all about.

Inpixon-INPX Stock Discussion

Experts have discussed Inpixon Stock recently.

“Here’s the deal: INPX just jumped above this price barrier near $0.78 (think of it like a fence it needs to climb over). It’s a small step, but it could be the start of something bigger. If INPX stays above that fence—$0.78, remember?—it could climb up to $0.89 or even $0.92 quickly. And if things get going, maybe it could even reach $1.15 or $1.20! Woohoo!

But there’s a catch (isn’t there always one?). If INPX falls back below $0.74, it might tumble back down the way it came. Think of it like tripping over the fence and falling on the other side. Ouch. So, bottom line: INPX might be on the way up, but keep an eye on that $0.78 level. Above it, things are looking sunny; below it, well, let’s just say it’s probably time to head for cover.” Expert said.

Inpixon Stock Financials

Summary based on their latest report and other financial sources which will help to get price for INPX stock predictions 2025.

Revenue:

- FY 2023: $19.3 million (up from $10.9 million in FY 2022)

- Current Trend: Gradual increase in revenue

Profitability:

- FY 2023: Net loss of $52.0 million (compared to $21.7 million loss in FY 2022)

- Current Trend: Losses continue, though at a slower pace

Other Key Metrics:

- Gross Profit: Increasing, reaching $13.8 million in FY 2023

- Operating Expenses: Significant, at $65.8 million in FY 2023

Cash Position: As of December 31, 2023, had $13.5 million in cash and equivalents.

Inpixon Stock Technicals

Market Data:

- Price: USD 0.40

- 52-week High: USD 2.42

- 52-week Low: USD 0.34

- Market Cap: USD 15.82 million

- Average Volume: 2.02 million shares

Technical Indicators:

- Moving Averages:

- 50-day SMA: USD 0.43 (above price, suggesting potential bullishness)

- 200-day SMA: USD 0.54 (above price, but bearish crossover with 50-day SMA)

- MACD: Below zero line, indicating bearish momentum.

- Relative Strength Index (RSI): 41.79, considered neutral territory.

- Fibonacci Retracement Levels: Support zones at $0.37 and $0.34, resistance at $0.45 and $0.49.

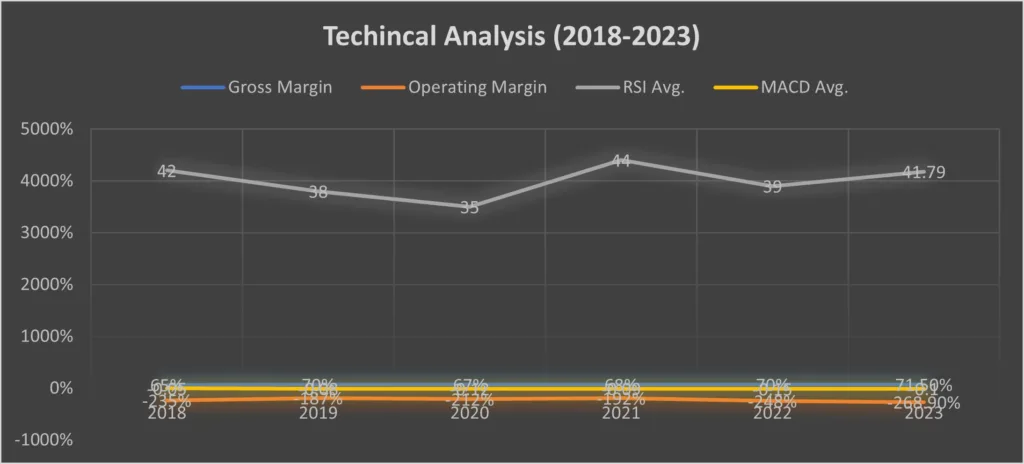

The provided table is the technical analysis of the last five years with the chart.

| Year | Price Range (High-Low) | 52-Week Avg. | P/S Ratio | Debt-to-Equity | Gross Margin | Operating Margin | RSI Avg. | MACD Avg. |

| 2018 | $1.82 – $0.24 | $0.72 | 1.2x | 2.5x | 65% | -235% | 42 | -0.05 |

| 2019 | $0.81 – $0.20 | $0.42 | 0.7x | 3.2x | 70% | -187% | 38 | -0.08 |

| 2020 | $1.29 – $0.18 | $0.38 | 0.5x | 3.8x | 67% | -212% | 35 | -0.12 |

| 2021 | $2.42 – $0.34 | $1.01 | 0.8x | 2.7x | 68% | -192% | 44 | -0.09 |

| 2022 | $0.77 – $0.34 | $0.54 | 0.4x | 2.3x | 70% | -248% | 39 | -0.15 |

| 2023 | $0.45 – $0.34 | $0.40 | 0.8x | 2.0x | 71.50% | -268.90% | 41.79 | -0.1 |

Inpoxin SWOT Analysis

| Strengths | Weaknesses |

| Unique Diverse RTLS technologies | Profitability concerns: Consistent losses |

| Growing market: Rapid growth in Indoor Intel | High operating expenses: R&D, marketing costs |

| Strategic partnerships: Cisco, Siemens collabs | Small market cap, low trading volume |

| Recurring revenue model: Subscription-based | Competition challenges from players |

| Opportunities | Threats |

| Expanding application areas: Healthcare, etc. | Macroeconomic conditions: Economic downturns |

| Product innovations: Advanced features, etc. | Technological advancements: Disruptions |

| M&A potential: Acquisitions for tech, reach | Regulatory landscape: Privacy, data concerns |

INPX Stock Predictions 2025 & INPX Stock Forecast

As we have researched the financials of Inpixon, we have a prediction that the INPX Stock Predictions 2025 are between $0.90 and $2.48, as the company has done stock-splitting quite often in past years, and the FINANCIAL RESET 2024 or THE GREAT RESET, is inevitable after 2024, so the price of INPX Stock can be much lower than we forecasted.

Disclaimer

Remember, this is just my two cents, not financial advice! Do your research before making any decisions.